Financial Consulting Software Market Research, 2031

The global financial consulting software market size was valued at $4.73 billion in 2021, and is projected to reach $14.86 billion by 2031, growing at a CAGR of 12.2% from 2022 to 2031.

Financial consulting software assists advisors, representatives, accountants, and individuals by offering a platform to develop appropriate financial plans. Furthermore, use of financial consulting software permits financial edge consultants and corporations to manage finances, business records, and other accounting needs to make effective decisions, which is expected to increase adoption of the software. This software also tracks financial accounts, categorizes income and expenses, makes synchronization with banks and card companies, analyzes investments, and shows tax-related reports to streamline and automate financial processes and improve productivity. In addition to this, oracle financial services consulting provides end user with enhance experience to improve their financial planning and to upsurge their revenue opportunities.

High rate of adoption by financial consulting software among HNIs and increase in demand for alternative investments drive the growth of the financial consulting software market. Moreover, increase in use of digital transformation technology boosts the growth of the financial consulting software market. However, lack of awareness about financial consulting software and increase in security concerns restrict the growth of the financial consulting software market. On the contrary, rise in innovations in the fintech industry is expected to offer remunerative opportunities for expansion of the financial consulting software market during the forecast period.

The financial consulting software market is segmented into Offering, Deployment Model, Enterprise Size and End-user.

Segment review

The financial consulting software market is segmented on the basis of offering, deployment model, end users, enterprise size, and region. On the basis of offering, the market is categorized into software and service. On the basis of deployment model, the market is bifurcated into on-premise and cloud. On the basis of enterprise size, the market is classified into large enterprise and SMEs. On the basis of end user, it is classified into banks, wealth management firms, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players that operate in the financial consulting software market are Accenture, Acorns Grow Incorporated, Active Intelligence Pte Ltd., Advicent Solutions, Deloitte, eMoney Advisor, LLC, Finastra Limited, Fiserv, Inc., Moneytree Software, Miles Software, Money Guide Inc., Orion Advisor Technology, Personal Capital Corporation, Quicken Inc., Right Capital Inc., SAP, and Wolters Kluwer. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

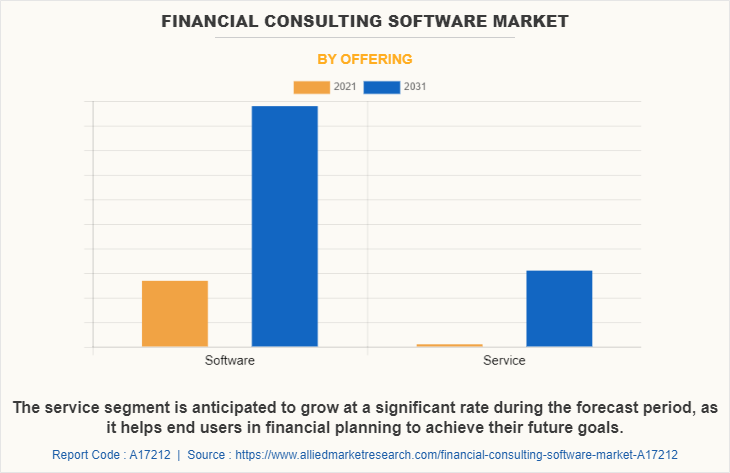

In terms of offering, the software segment holds the largest financial consulting software market share as it helps in successfully managing the business process without some sort of an accounting system. However, the service segment is expected to grow at the highest rate during the forecast period as it can maximize SMEs pricing by the value they deliver to their small business clients.

Region-wise, the financial consulting software market size was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the region’s outstanding financial situation, which allows to invest substantially in the adoption of cutting-edge tools and technology to ensure that business operations are running smoothly and leverage financial growth. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to growing awareness regarding financial consulting software.

COVID-19 Impact Analysis

The financial consulting software market is projected to prosper in the COVID-19 situation. Owing to this various companies are adopting the work-from-home module during the pandemic. In addition, companies are decreasing their investment in new technologies and services to manage revenues. Furthermore, many small businesses closed their business processes due to lack of funds to sustain in the market and some withheld all investments in advanced business solutions and tools due to the low return on investment. Thus, demand for financial consulting software decreased during the COVID-19 lockdown situation.

Moreover, IT businesses are expanding product offerings and services to make them more widely available globally. As a result, rise in number of Software as a Service (SaaS) and cloud-based client interaction, remote connection, and collaboration services has seen a large spike in new sign-ups across its entire product range owing to the COVID-19 pandemic, which drives the financial consulting software market growth.

Top Impacting Factors

High rate of adoption by financial consulting software among HNWIs (high-net-worth individual)

The number of HNWIs is increasing across the globe owing to better financial management and correct investments. Moreover, given their substantial assets, high-net-worth households require additional services from financial consulting software. Financial consulting software for HNWIs include, investment management and tax advice as well as help with trusts and estates and access to hedge funds and private equity firms. Furthermore, around 13% financial advisor clients fall under the umbrella of high net worth. In addition, HNWIs are in high demand for financial consulting software as more the money, more work is required to maintain and preserve those assets. These individuals generally demand personalized services in investment management, estate planning, tax planning, and so on. Such demands are driving the growth of the financial consulting software industry.

Increase in demand for alternative investments

Alternative investments is an ever-evolving industry, and opportunities emerge regularly. The industry is expected to see new opportunities for international investment as well as new types of alternatives to invest in. In addition, in recent years, it branched out into an international market, creating new opportunities to use strategies that have already run their course in the U.S. Moreover, a 2020 survey by Connection Capital found that 87% of the private investors surveyed were planning on maintaining or increasing their allocation to alternative investments over the next 12 months. Furthermore, many investors are using alternative investments, such as real estate, as safe haven investments. This asset class is providing many advantages of traditional safe haven investments including a lack of correlation to equities, lower volatility, and strong performance through market cycles while offering the potential for much better returns than highly rated sovereign bonds. Therefore, investors are enabling financial consulting software to have a secure investment during the pandemic, which in turn is driving the growth of the financial consulting software industry.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the financial consulting software market forecast, segments, current trends, estimations, and dynamics of the financial consulting software market analysis from 2021 to 2031 to identify the prevailing financial consulting software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the financial consulting software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global financial consulting software market outlook.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global financial consulting software market trends, key players, market segments, application areas, and financial consulting software market opportunity.

Financial Consulting Software Market Report Highlights

| Aspects | Details |

| By Offering |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By End-user |

|

| By Region |

|

| Key Market Players | AlixPartners, Boston Consulting Group, Active Intelligence Pte Ltd, Alvarez & Marsal Holdings, LLC, Acorns Grow Incorporated |

Analyst Review

Financial consulting software is a tool designed to integrate the financial data of a user and segregate this information to deliver a desired analytical output for improved financial planning. This software tool utilizes a variety of financial data as input and can be implemented for various tasks, such as financial transactions, bank records management, investment tracking, budget management, portfolio management, and others.

Financial consulting software enable businesses to obtain gross profit margin, working capital, and return on equity. Moreover, the increasing demand for improved accounting and finance operations is driving the growth of the financial consulting software market. With growth in requirement for factoring services, various companies have established alliance to increase their capabilities. For instance, in May 2022, Fidelity International partnered with the Canadian FinTech company, Conquest. The strategic partnership brings an innovative approach to financial planning, helping advisers to build plans faster and more efficiently and to modernize the practice of advice delivery in the UK.

In addition, with the rise in demand for financial consulting software, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in May 2021, KPMG launched Finance plus, a new bookkeeping and financial reporting platform tailored to SMEs. The platform is aimed at SME business owners who lack the time or in-house capabilities to manage bookkeeping and financial reporting, according to a release from the consulting firm. The product has benefits businesses from standard reporting and analytics and would like to leverage stronger insights from their financial information.

Moreover, with increase in competition, major market players have started acquiring companies to expand their market penetration and reach. For instance, in April 2022, Cyient, global technology solutions firm acquired Singapore-based, Grit Consulting. The acquisition is expected to more than double the number of consulting led growth strategy that Grit makes annually and establish Grit as the largest business transformation and technology solutions capabilities in Singapore.

High rate of adoption by financial consulting software among HNIs and increase in demand for alternative investments drive the growth of the financial consulting software market.

Region-wise, the financial consulting software market size was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the region’s outstanding financial situation, which allows to invest substantially in the adoption of cutting-edge tools and technology to ensure that business operations are running smoothly and leverage financial growth.

The global financial consulting software market was valued at $4.73 billion in 2021, and is projected to reach $14.85 billion by 2031, registering a CAGR of 12.2% from 2022 to 2031.

The key players that operate in the financial consulting software market are Accenture, Acorns Grow Incorporated, Active Intelligence Pte Ltd., Advicent Solutions, Deloitte, eMoney Advisor, LLC, Finastra Limited, Fiserv, Inc., Moneytree Software, Miles Software, Money Guide Inc., Orion Advisor Technology, Personal Capital Corporation, Quicken Inc., Right Capital Inc., SAP, and Wolters Kluwer. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...